Datu Ang has been for 11 months, the appearance is domineering, the power is strong, and the super space meets my personal needs. Due to responding to the national call and promoting carpooling for the sake of environmental protection, the commuting rate is not particularly high at ordinary times. In a year, it is only more than 10,000 kilometers, except for the first insurance and a free disinfection in the car. Using the car for one year means that the car insurance has expired. buying insurance is a relatively large expenditure on using the car. What we buy is rest assured that the car without insurance dare not use it for a minute.

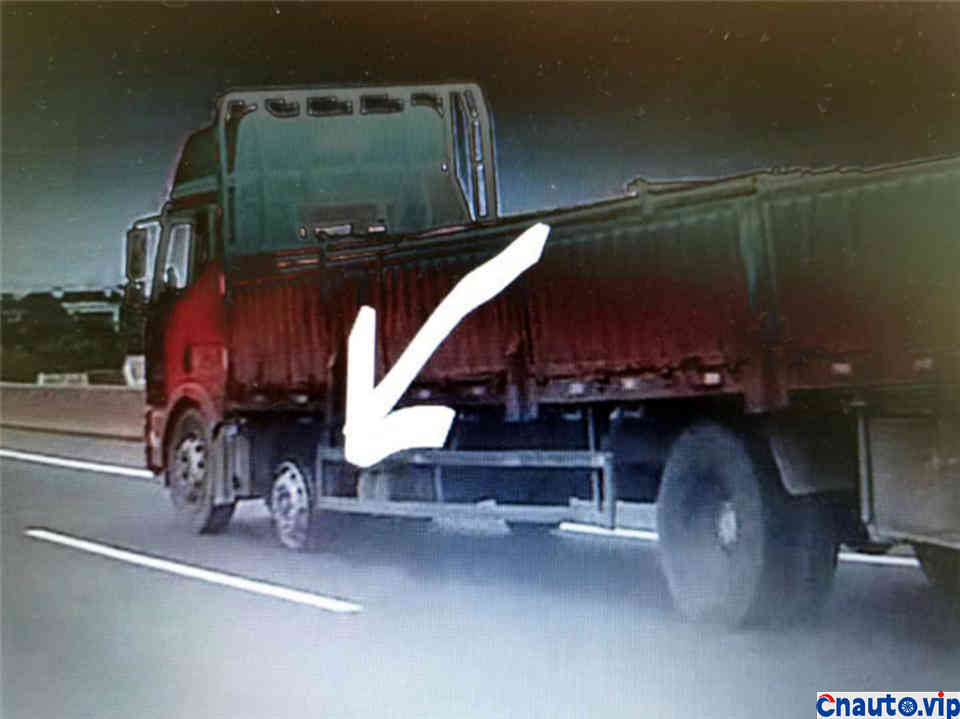

On that day, there happened to be a traffic accident on the highway, because a truck did not pay attention to the usual maintenance, or bought fake and shoddy tires for small profits, resulting in several cars, which was a sudden disaster for them, but fortunately the accident was not big. It’s a blessing in misfortune.

On the same day, I also encountered several cars with no lights on the road. This driving habit has to be severely criticized, and now there are many surveillance. This kind of violation is filmed, and the transportation department will give it a fine deduction and a warning. Then there is a certain increase in the insurance rate. Therefore, it is very necessary to develop good driving habits and be responsible for yourself and others.

Let’s know about the classification of car insurance, compulsory insurance and commercial insurance before buying insurance.

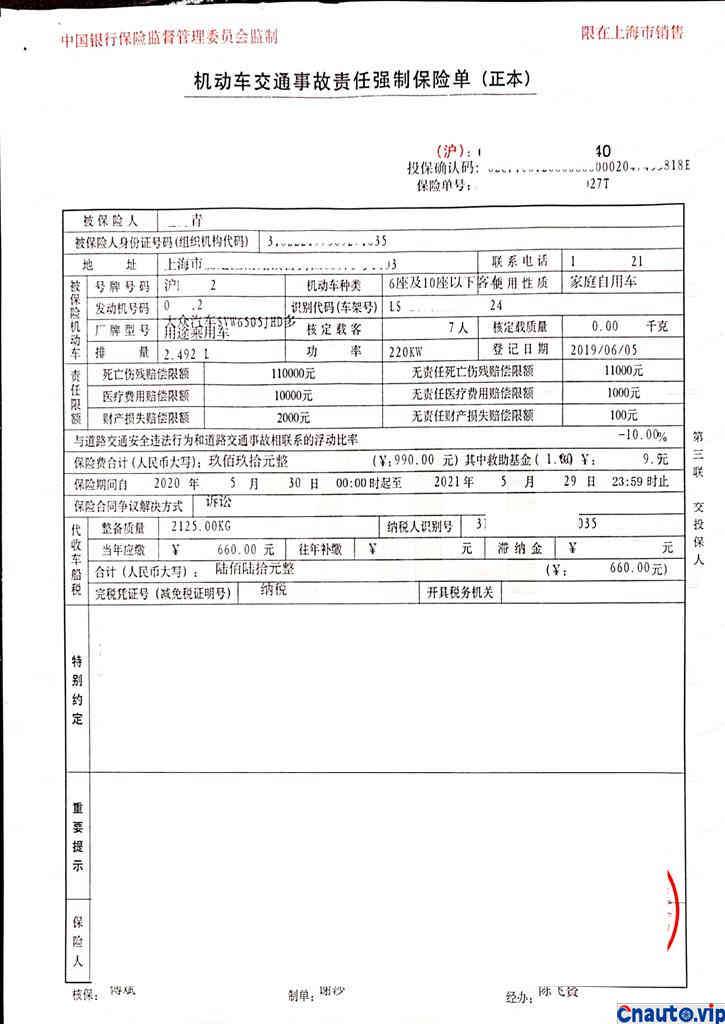

Compulsory traffic insurance belongs to compulsory insurance, and the insurance premium for motor vehicles that must be purchased by law is set uniformly by the state, but the price of compulsory insurance is also different, and the main influencing factor is the number of seats in the car. A 7-seat Tuang is a little more expensive than an ordinary family car.

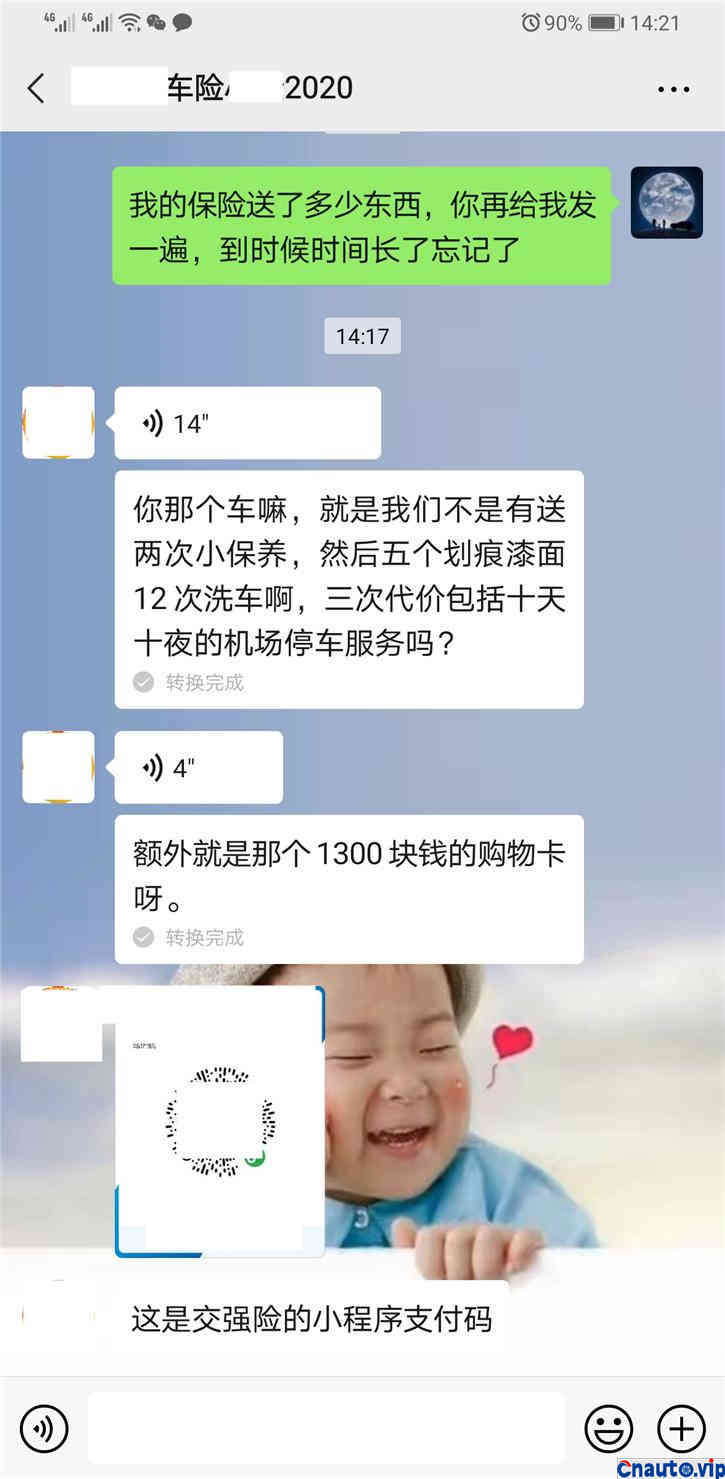

Commercial insurance chooses to buy according to its own will. To buy insurance, first look at its services. At present, the services of large insurance companies are basically the same, claims settlement speed, road rescue and so on. Small insurance companies have not tried, but they have heard that it is very troublesome to settle claims. Secondly, they do not look at the price. Several insurance companies are unified in the price inquiry. Now in the era of networking, in order to avoid unfair competition, we will fight a price war. It is a good thing for us to consume, there is no need to bargain, and the price is clearly marked to save time and effort, but at the same price, the major insurance companies will give away some small gifts to seize the car insurance market with the practicality of the gift project.

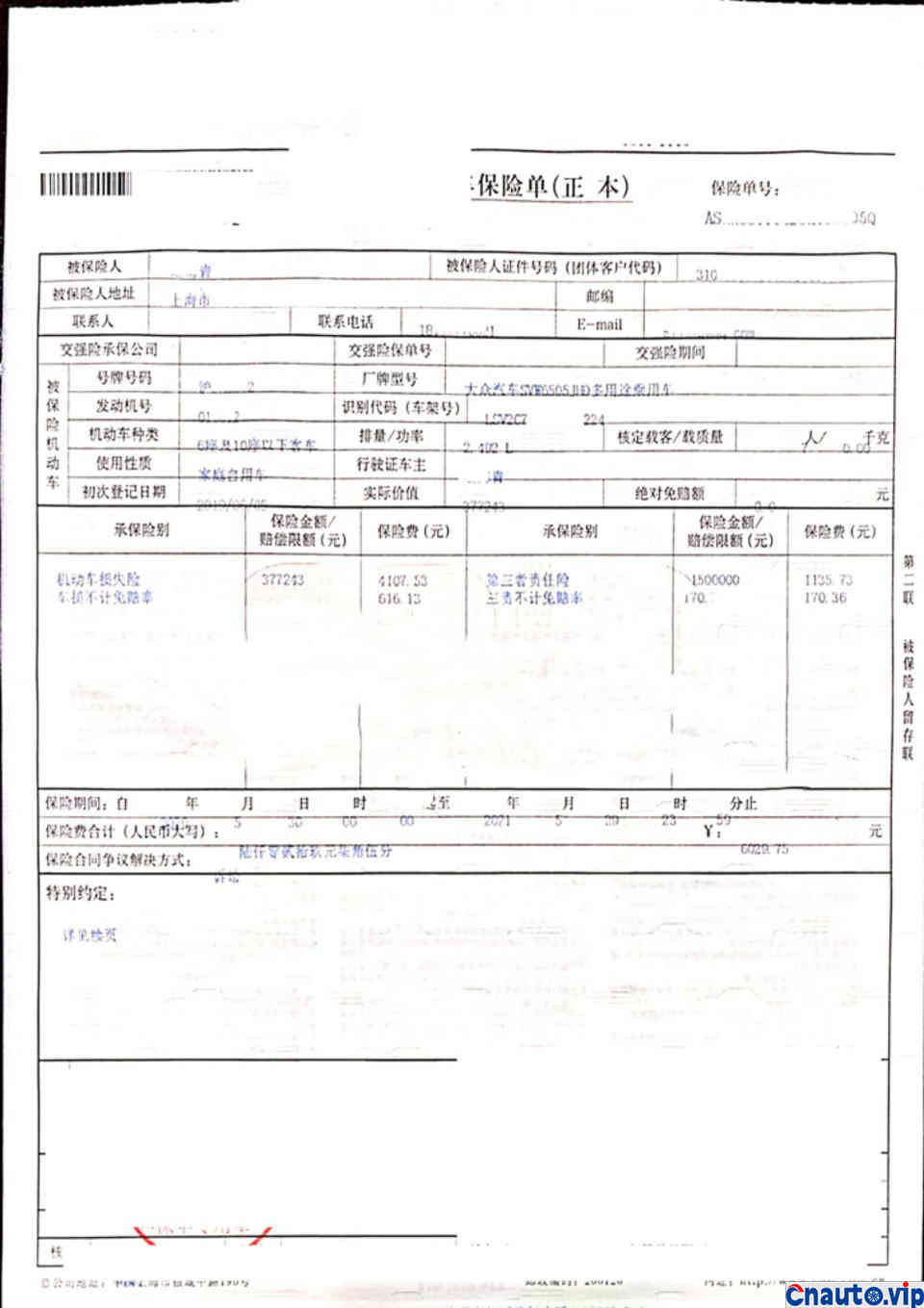

Commercial insurance is divided into basic insurance and additional insurance, in which additional insurance can not be independent insurance. Basic insurance includes third party liability insurance and vehicle damage insurance; additional risks include theft and rescue insurance, vehicle liability insurance, no-fault liability insurance, vehicle cargo drop liability insurance, glass insurance, vehicle parking loss insurance, spontaneous combustion insurance, new equipment loss insurance, excluding exemption. The traffic insurance that we usually say, also belongs to the third party liability insurance, the traffic insurance is compulsory, the motor vehicle must be purchased before it can be driven on the road, the annual inspection, the household, and when the third party loss needs to be settled, you must first pay for the compulsory insurance and then pay for other types of insurance.

No deductible insurance is an insurance that takes effect only when purchased together with the third liability insurance. If you don’t buy it, you will be responsible for 5% to 20% of your liability.

The insured amount of car damage insurance is the amount determined according to the value of the vehicle. There was an accident, resulting in damage to his vehicle.

There are only a few practical ones, but I think it is necessary to buy glass insurance if you often run at high speed.

I remember buying many kinds of insurance when I first bought a car, including theft and rescue, scratch insurance, spontaneous combustion insurance, etc., the salesman will sell you a lot of unpopular insurance types, the probability of those used is very low, what is vigorously promoted this year is seat insurance. I believe that many car owners have felt the enthusiasm of insurance salesmen.

Every year is two months before the expiration of the car insurance, the salesman of the insurance company begins to contact the car insurance to renew the insurance, but it is also a good thing. On the one hand, you can remind yourself not to forget; second, you can find out the price first. After that, I will contact other insurance companies to see if there is a big discount on gift coupons. Under normal circumstances, the renewed insurance company will give more profits to regular customers. In terms of discounts, there is an increase to a certain extent every year for cars that have not been in danger. There is a premium discount of about 10% for cars that are not out of danger in a year, which can reach 30% for several years in a row, but my car has not been insured for six years before. After changing the car, it is calculated from scratch, and this policy is to follow the car and not follow people.

In the settlement of insurance claims, we need to pay attention to timely report within 48 hours, such as road accidents, after the traffic police issued a certificate, the repair shop can handle it; non-road accident bicycle accidents need to write their own certificate, the police station seal. Basically all need 110 proof, later things are relatively easy to deal with.

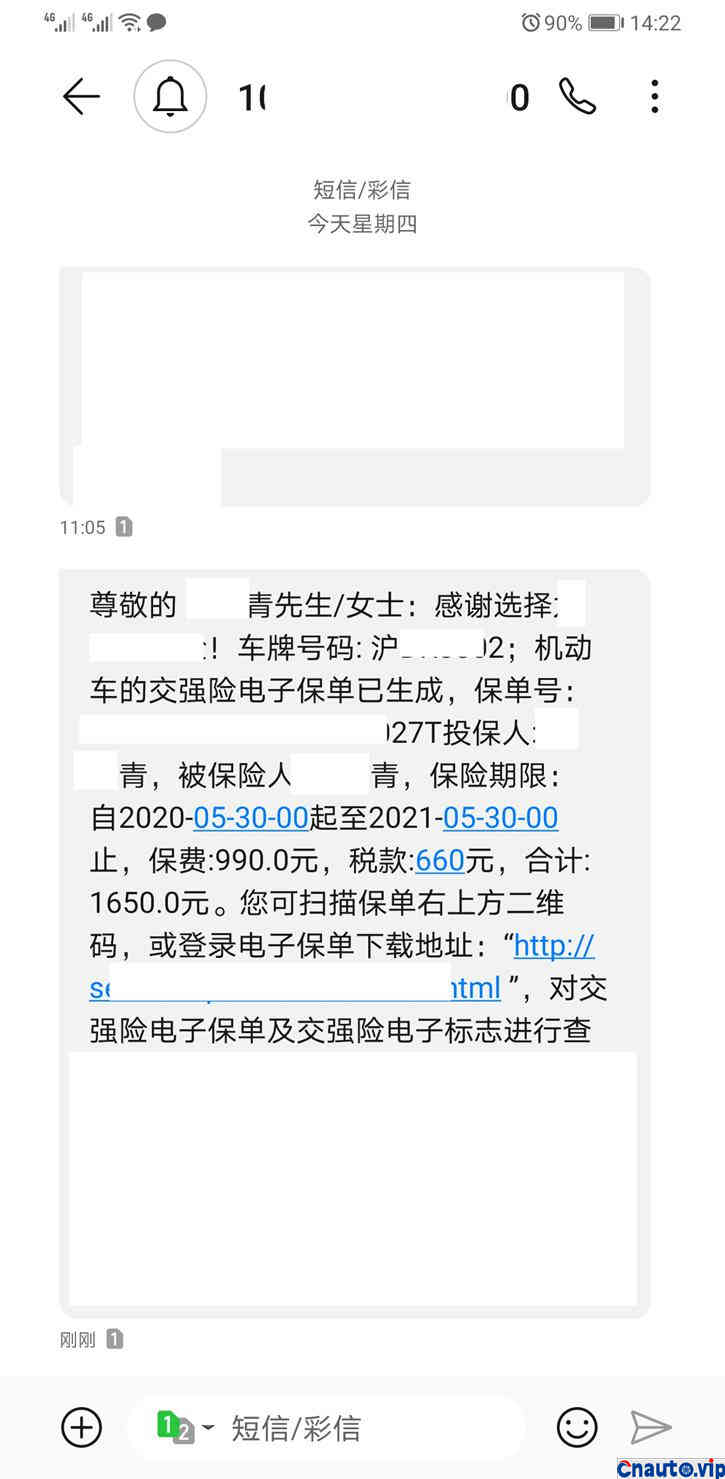

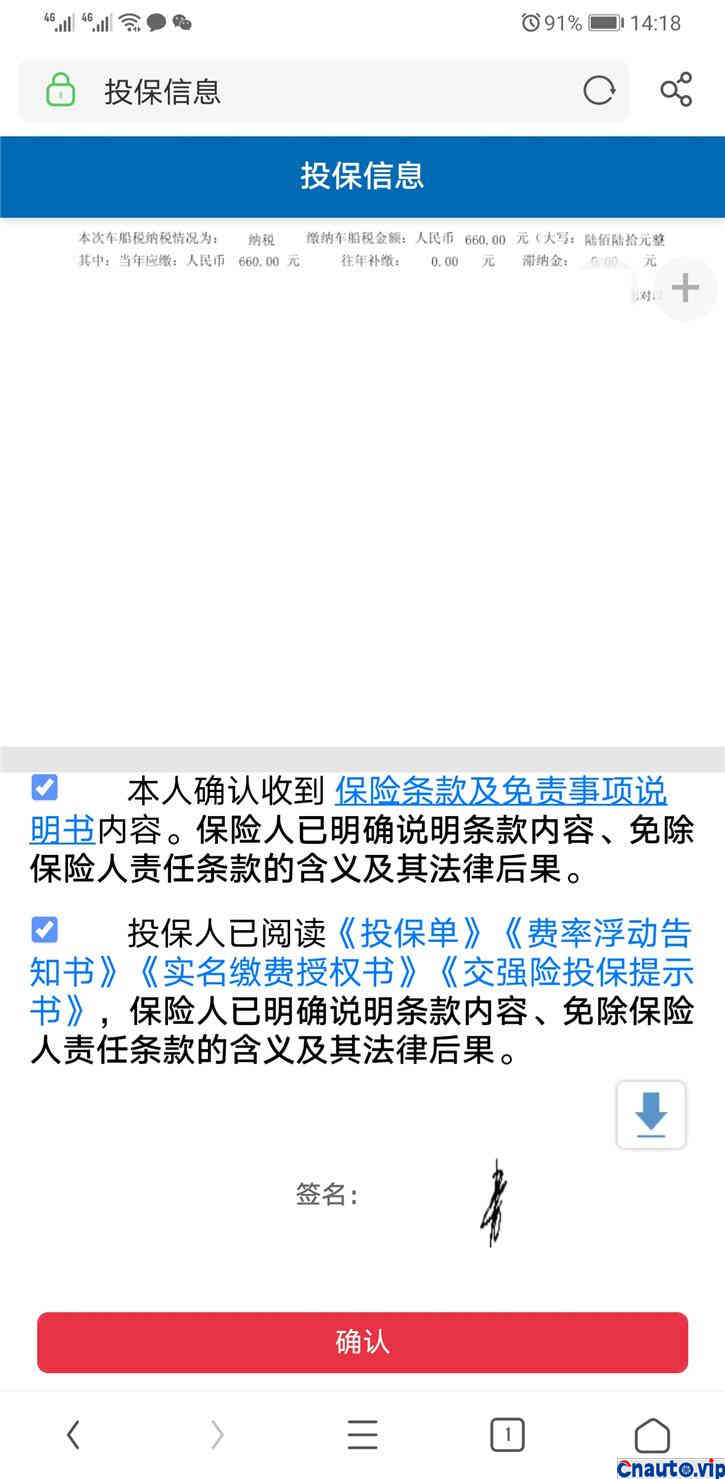

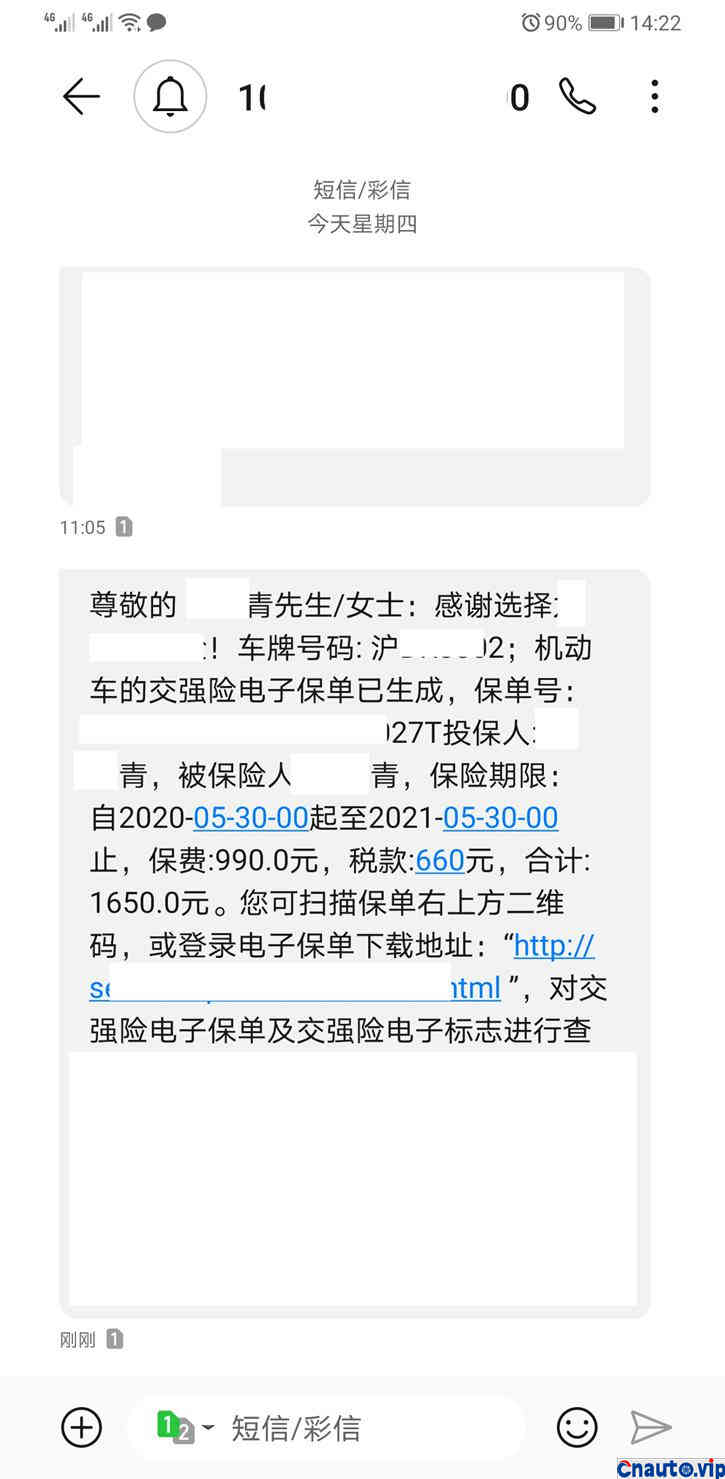

Now after the salesman of the insurance company confirms the type and price of the insurance on the phone, he will send a short message directly to the payment link to the mobile phone. After clicking in according to the URL on the mobile phone, he will pay with Wechat and Alipay. It only takes a few minutes.

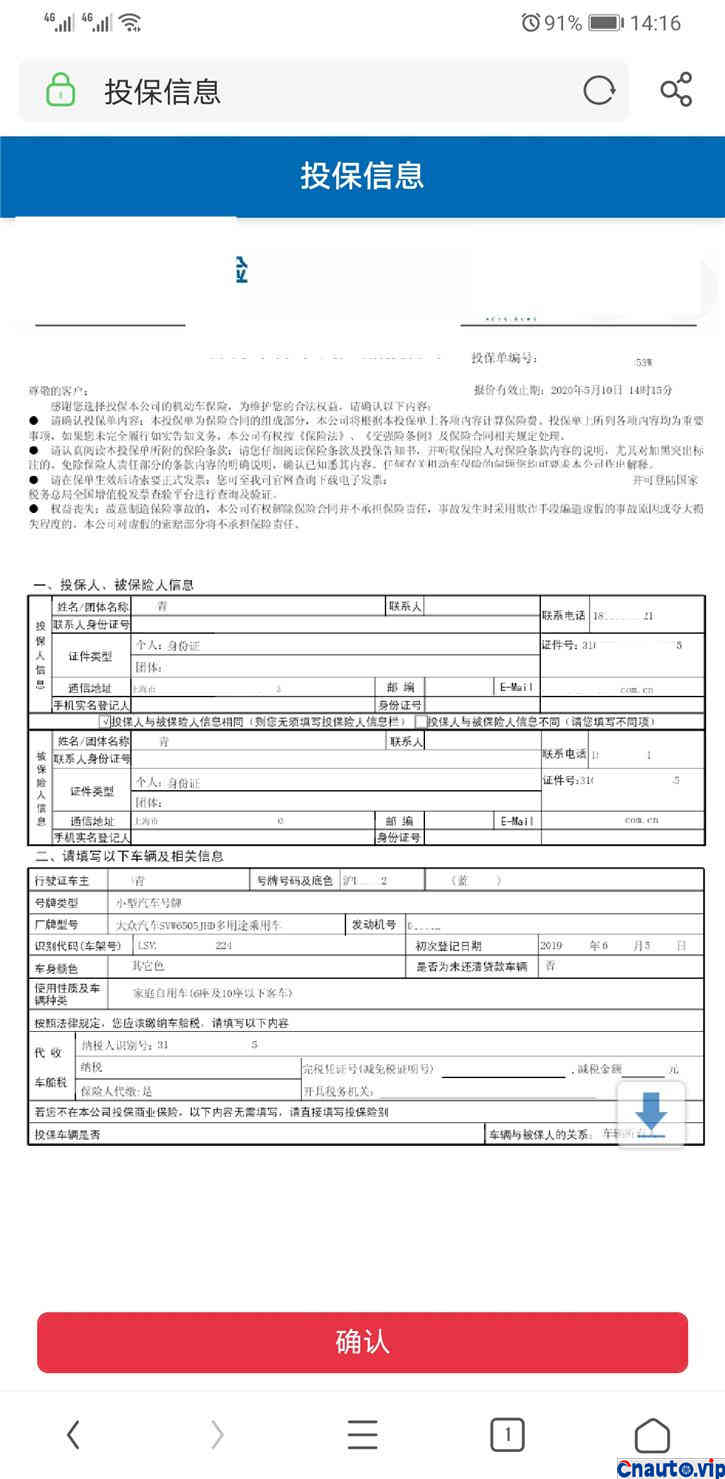

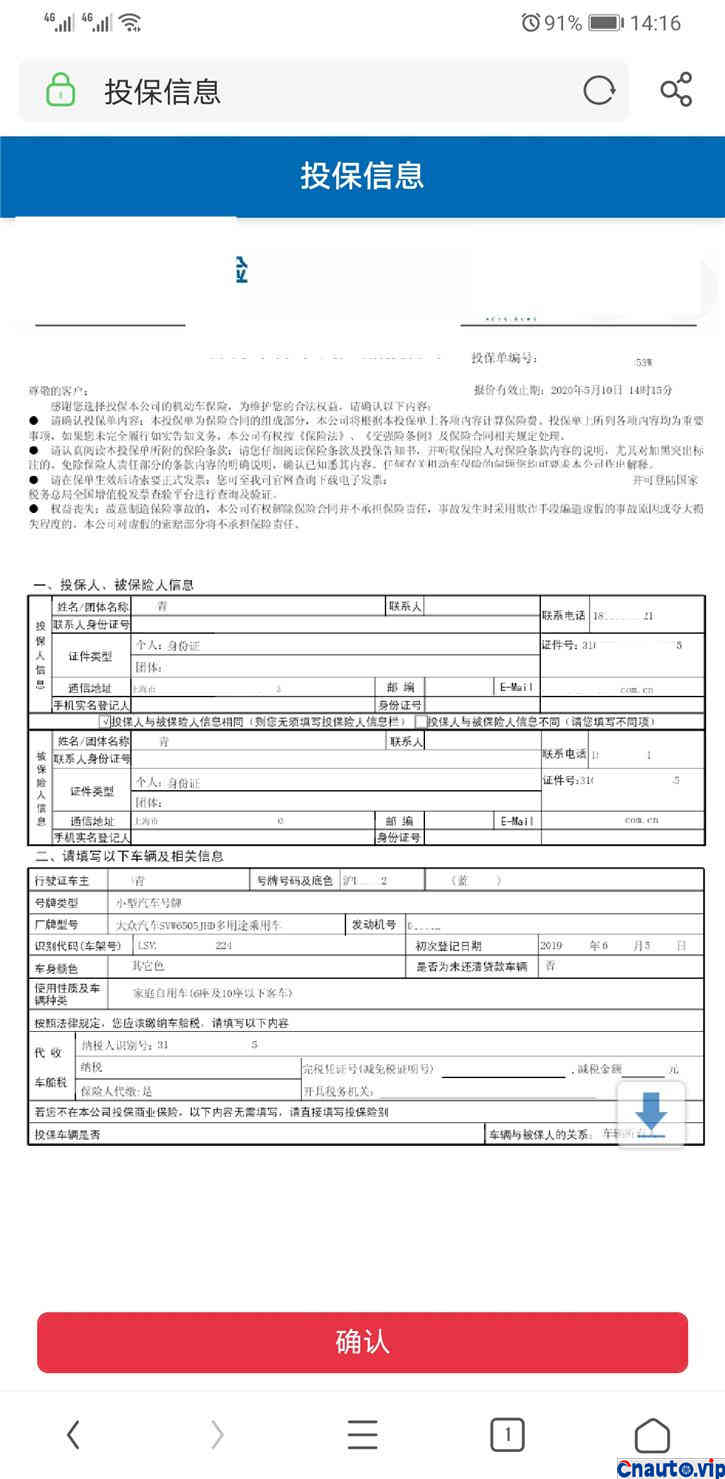

Take compulsory traffic insurance as an example, the steps are as follows:

Confirm check information

Send a link

Click the link after confirmation

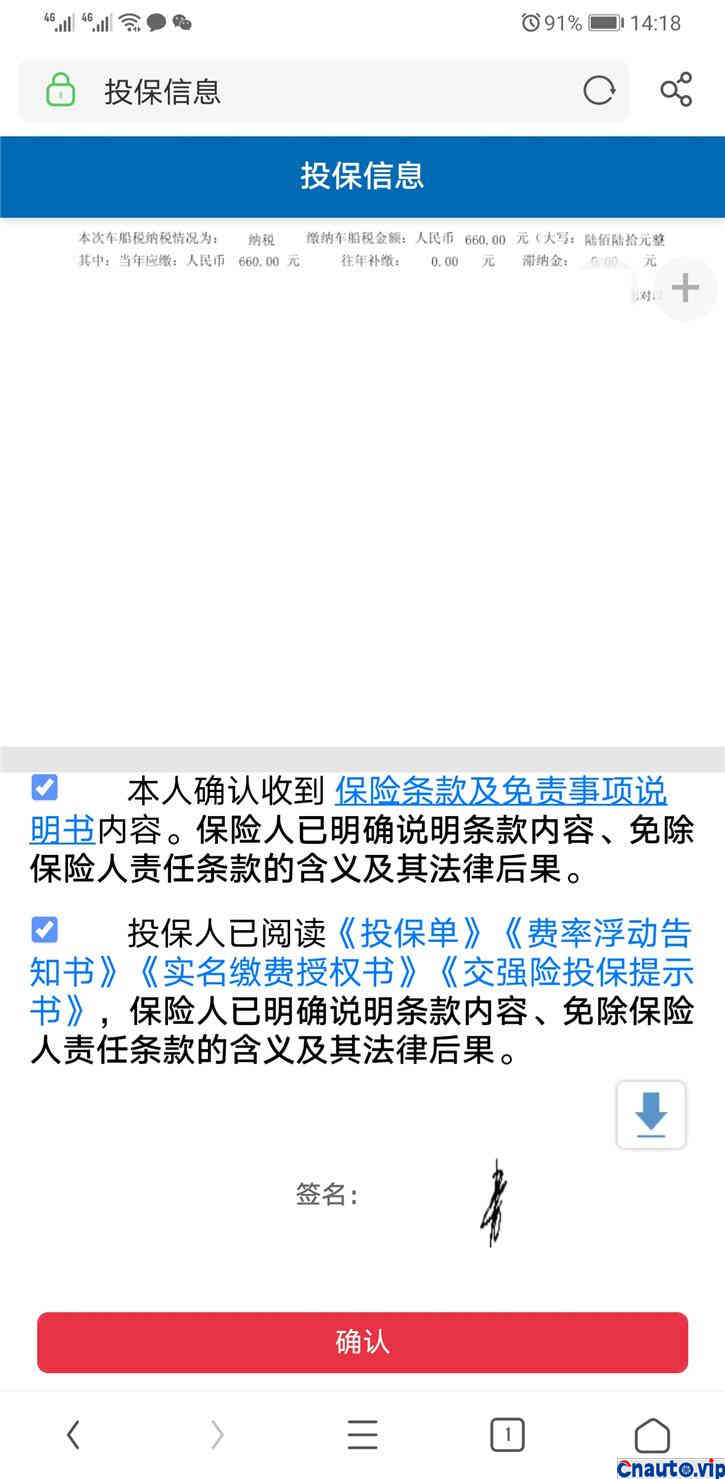

Policy information display

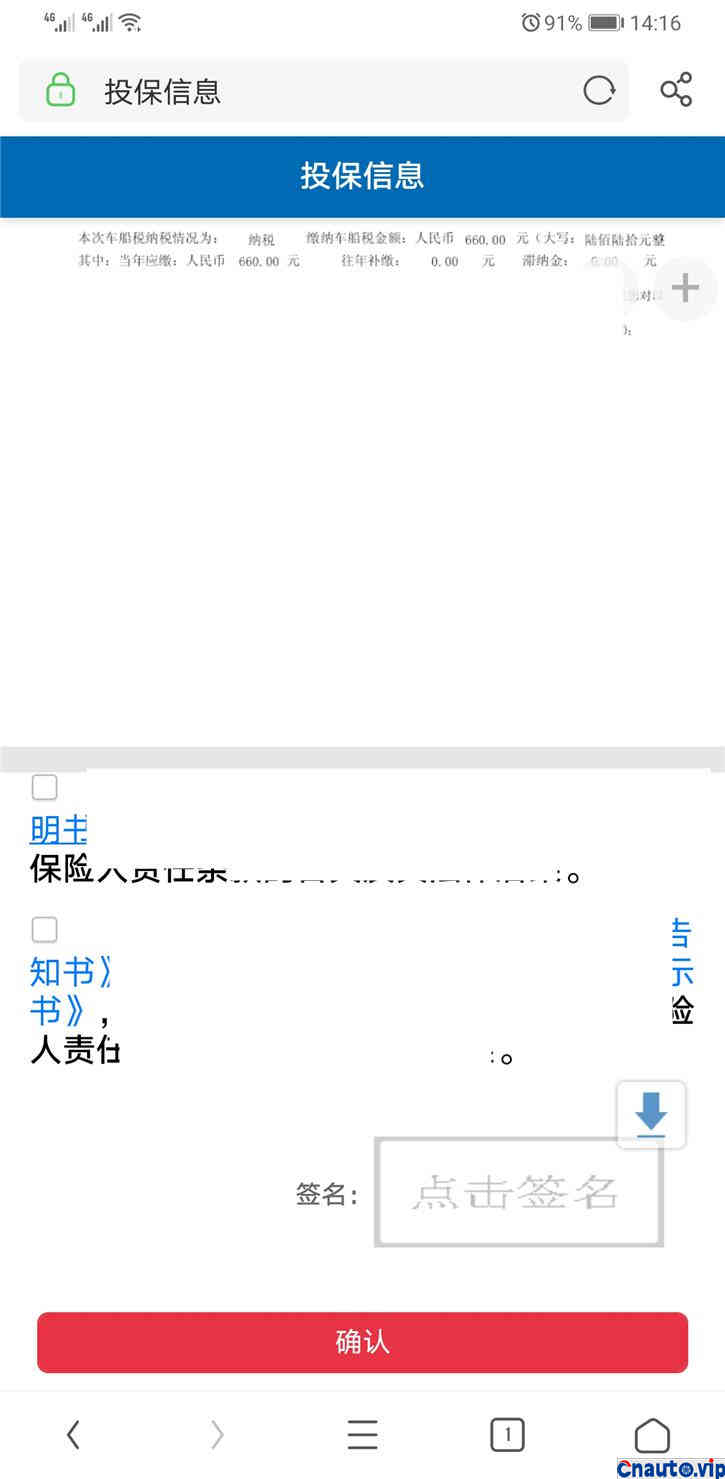

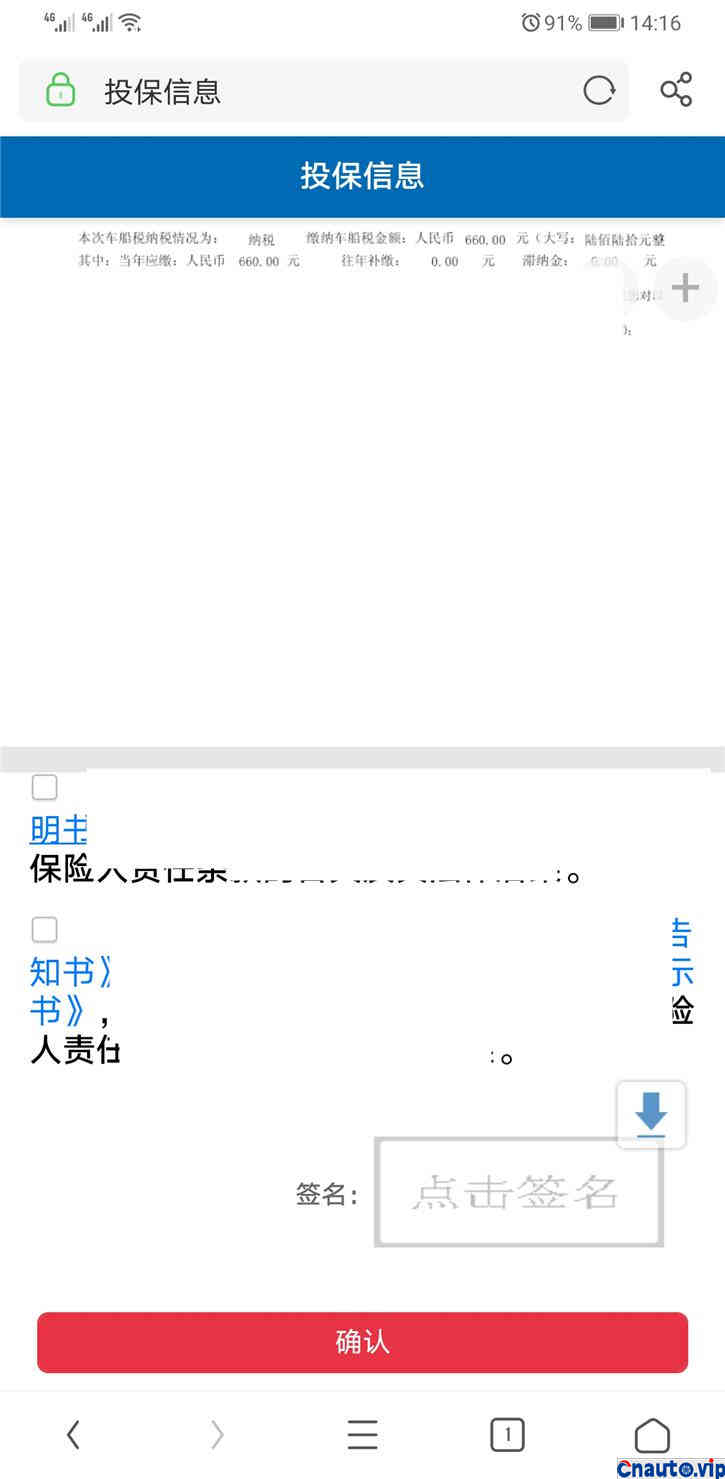

Click to display meization information

After reading the insurance regulations, click I have read

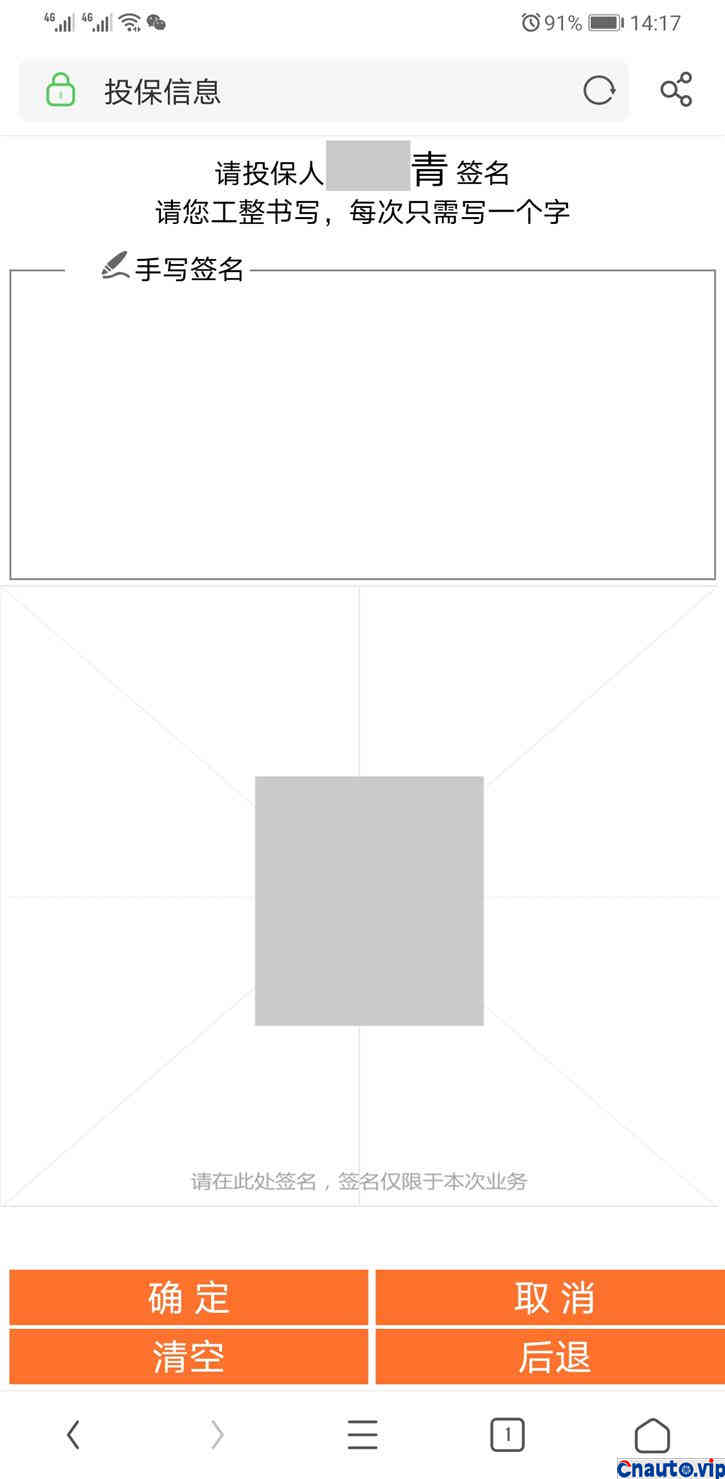

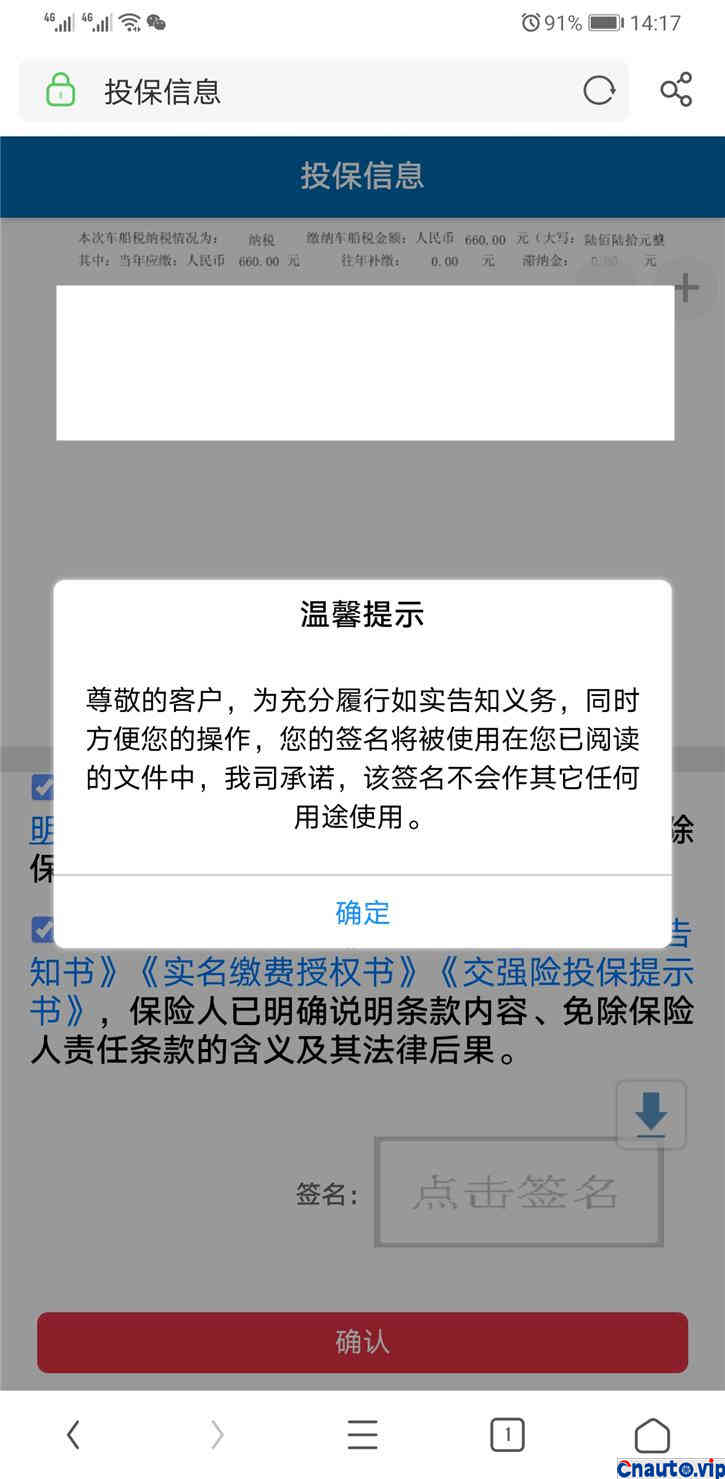

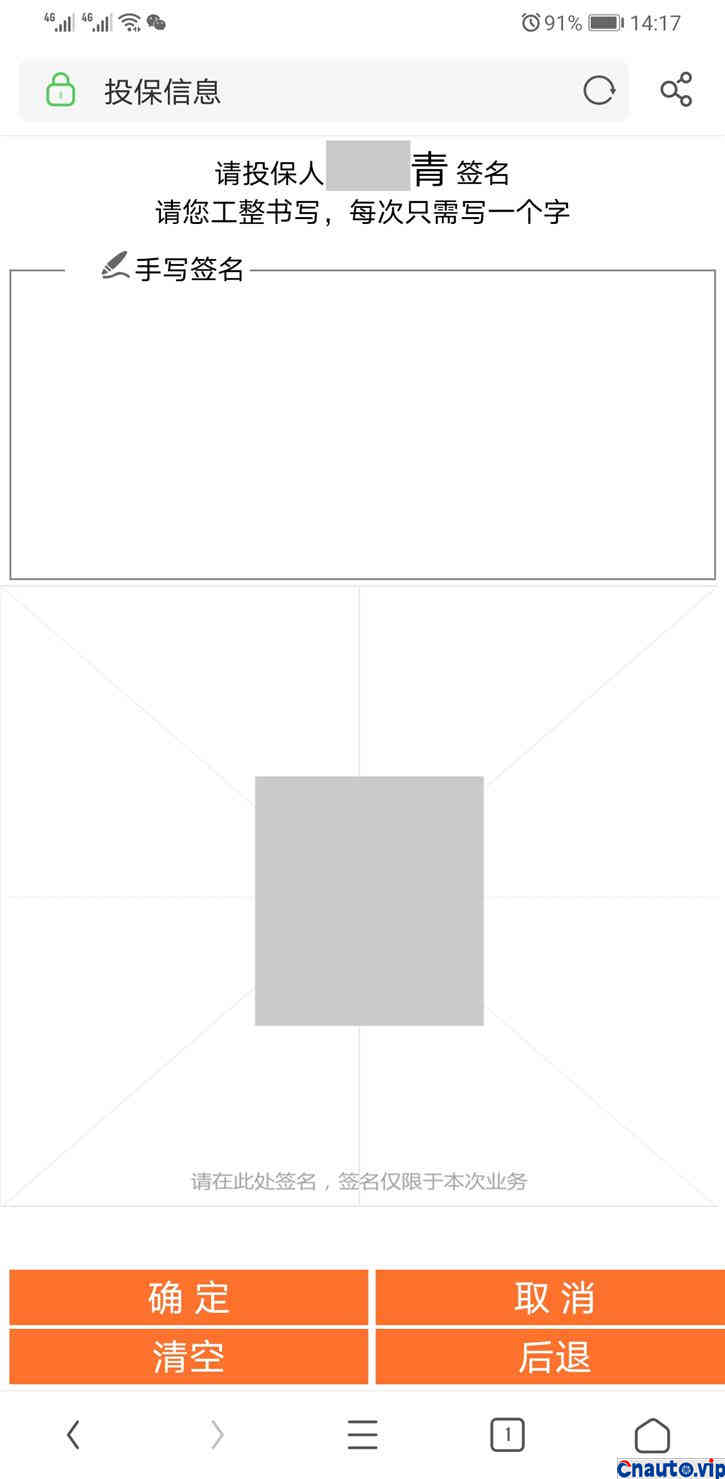

Handwritten signature confirmation

The online signature also has legal effect.

The choice between Alipay and Wechat

End of payment

The payment will not be repeated, and the payment is quite safe and convenient.

Although there is an electronic insurance policy, but so many years of habits, written easy to consult or apply, the next day the insurance policy will be mailed home, saving time and effort.

A lot of things have been given away, some of which are quite practical.

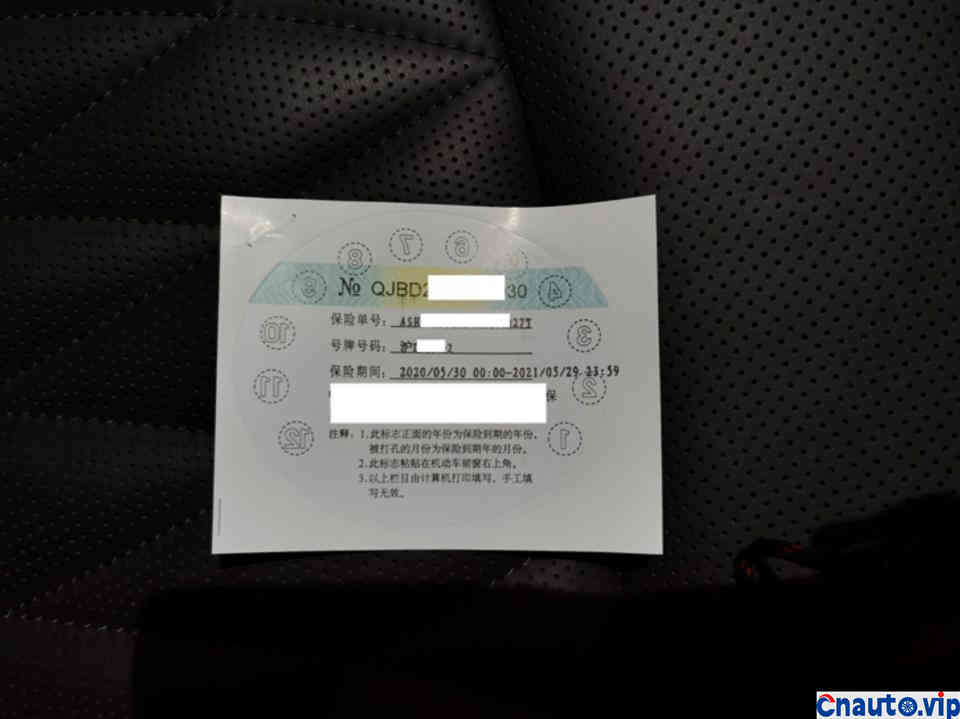

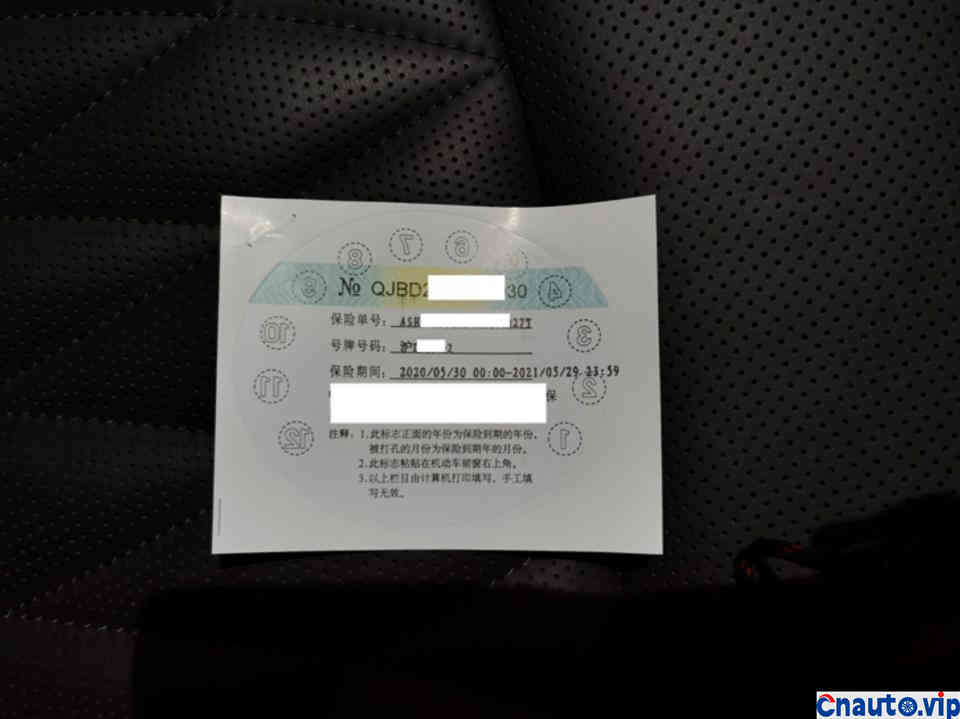

Now many cities do not need to paste this paper label.

As usual, there are these kinds of insurance every year. By comparison, the price of the first year is quite different from that of the second year without getting out of danger.

April 1, 2024

April 1, 2024